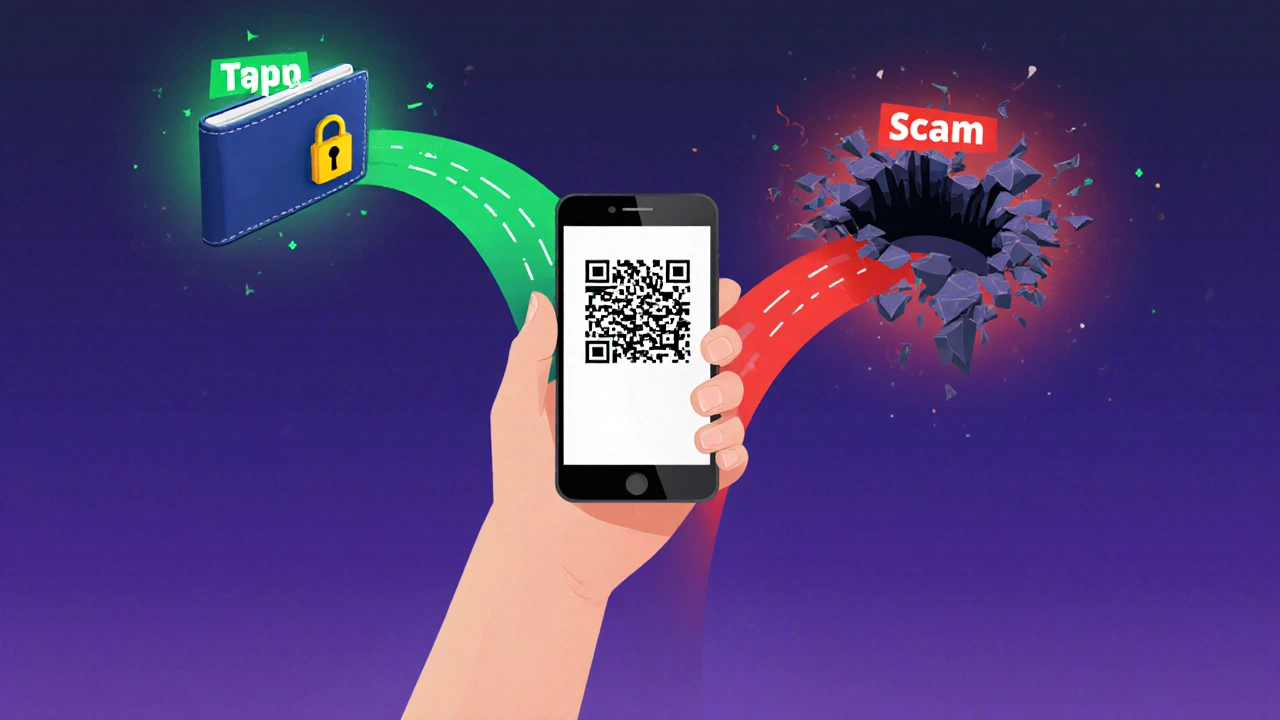

Scan a QR code to pay for something in crypto? Sounds easy. But what if that code doesn’t lead to your friend’s wallet-or the merchant’s-but straight to a scammer’s account? By November 2025, QR code scams in crypto have become one of the most dangerous tricks targeting everyday users. Not because they’re high-tech. But because they’re stupidly simple-and you’ve probably been told to trust them.

How QR Code Scams Work

Here’s how it usually goes: You get a message-maybe from someone pretending to be Coinbase support, or a QR code stuck on a crypto ATM screen, or a link in a Facebook ad saying "Free Bitcoin! Scan to Claim." You scan it. The screen shows a clean, familiar-looking interface. Maybe it even has a fake Google reCAPTCHA to make you feel safe. You confirm your wallet connection. You enter the amount. You hit send.

And just like that, your crypto is gone.

The trick? The QR code doesn’t show the real wallet address. It’s been rigged. Behind the scenes, JavaScript replaces the correct address with one controlled by the scammer. You’re not sending money to the person you think you are. You’re sending it to a criminal who’s already sitting on five different Bitcoin wallets, all funded by people just like you.

Chainalysis reports that in 2025, personal wallet compromises-mostly through QR codes-accounted for 23.35% of all stolen crypto, totaling over $508 million. That’s not a glitch. It’s a business model.

Why QR Codes Are Perfect for Scammers

Think about it: Why would anyone suspect a QR code? We use them for everything. Paying for coffee. Checking into hotels. Scanning product labels. They’re fast. They’re trusted. And most people never check what’s underneath.

Scammers know this. That’s why they’ve shifted from phishing emails (which people are starting to ignore) to QR codes-which still feel harmless. According to Malwarebytes, QR code scams jumped 327% from 2024 to 2025. And they’re working: 68% of novice users fall for them. Compare that to phishing emails, which only succeed about 28% of the time.

At crypto ATMs, it’s even worse. The Department of Financial Protection and Innovation found that 18% of all crypto ATM fraud in Q3 2025 happened because victims scanned a QR code given to them by a scammer. The machine didn’t cheat. The person standing next to you did.

The "Best Wallet" Scam: A Masterclass in Deception

One of the most dangerous scams, called "Best Wallet," appeared in October 2025. It looked exactly like a real wallet app. It had a clean design. It had a working reCAPTCHA. It even asked you to connect your wallet with a button that said "Secure Connection."

But here’s the catch: once you connected your wallet, the JavaScript didn’t just replace the address. It also hijacked your clipboard. So if you copied a wallet address to paste it somewhere else-say, to double-check-it got swapped with the scammer’s address before you even pasted it.

Ledger Academy found that 92% of fake crypto sites now use clipboard hijacking. That means even if you think you’re being careful, your own tools are being used against you.

Who Gets Targeted?

It’s not just the elderly or the clueless. The DFPI’s data shows 63% of victims are between 25 and 44. These are people who use crypto regularly. They’ve bought Bitcoin. They’ve traded on exchanges. They think they know what they’re doing.

But they’re rushed. Scammers pressure them: "This offer expires in 15 minutes!" or "Your account will be frozen if you don’t verify now!" That panic overrides caution. And when you’re in a hurry, you don’t check the first four and last four digits of a wallet address. You just scan and send.

Reddit threads like r/CryptoScams are full of stories from people who lost $30,000 in Bitcoin after scanning a QR code from someone claiming to be support. One user, u/CryptoNewbie2025, lost 0.5 BTC after a fake call. Over 287 people replied saying the same thing happened to them.

How to Protect Yourself

Here’s the hard truth: You can’t stop scammers from making fake QR codes. But you can stop them from stealing your money.

Follow these seven steps every single time:

- Never scan QR codes from unsolicited messages. Not from Telegram. Not from Facebook. Not from a stranger at a crypto ATM. If you didn’t initiate the transaction, don’t scan.

- Manually type wallet addresses when possible. Even if it’s slow. Even if it’s annoying. Typing forces your brain to engage. Scanning lets you ignore.

- Always verify the first 4 and last 4 characters of any wallet address. A Bitcoin address looks like bc1qxy2kgdygjrsqtzq2n0yrf2493p83kkfjhx0wlh. If the last four are "wlh" but the QR code shows "wl8"-stop. Don’t send.

- Use a hardware wallet. Devices like Ledger or Trezor show you the full address on their screen before you confirm. If the address on your phone doesn’t match the one on your hardware wallet? Cancel. Always.

- Enable transaction previews. Most wallets now let you preview the recipient address before signing. Read it. Slowly. Out loud if you have to.

- Install a scam address blocker. Browser extensions like MetaMask’s built-in scam detection or WalletGuard flag known bad addresses. They’re not perfect, but they catch the most common ones.

- Never trust a QR code from a crypto ATM unless it’s generated by the machine itself. If someone hands you a printed QR code or points to a screen with a code, walk away. Legitimate ATMs don’t work that way.

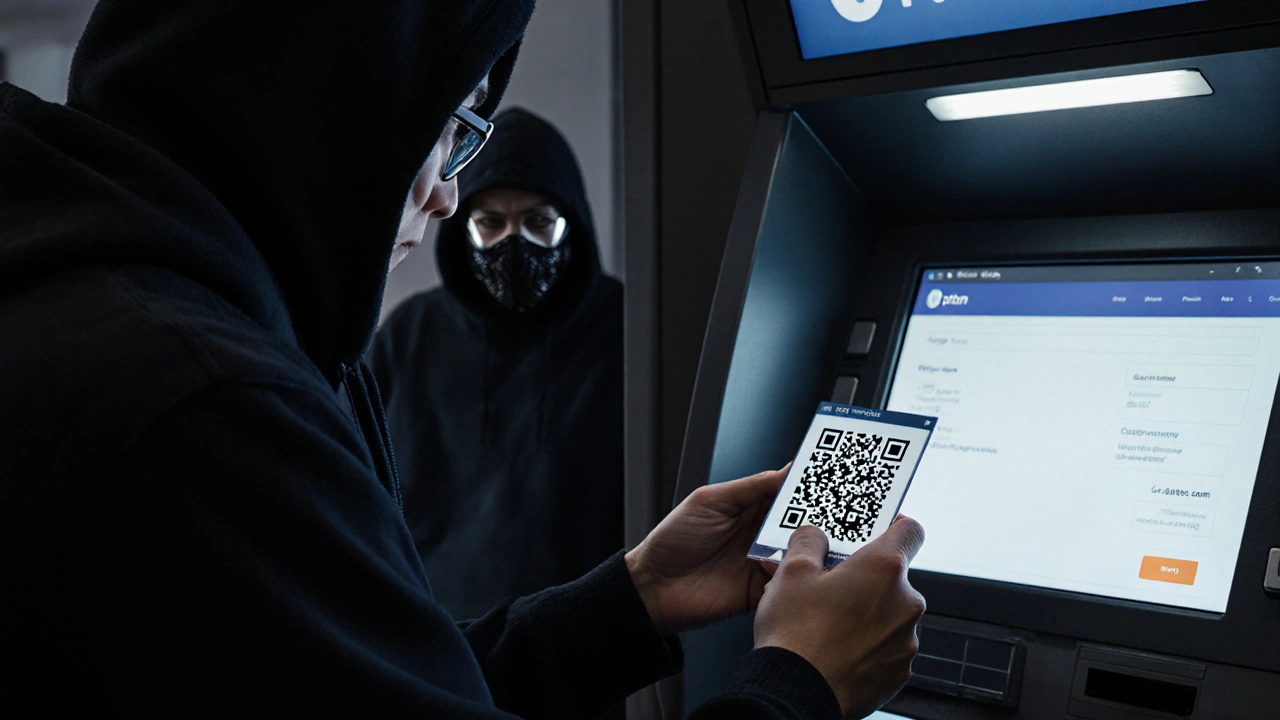

What About Crypto ATMs?

Crypto ATMs used to be safe. Now? They’re the #1 physical location for QR code scams.

Here’s how it works: You go to a machine. You select "Buy Bitcoin." You enter your wallet address. The machine prints a QR code. But before you scan it, a person in a hoodie walks up and says, "Hey, I’m from support. This machine is having issues. Use my QR code instead-it’s faster."

That’s not support. That’s a thief.

As of Q4 2025, 12 of the top 15 ATM manufacturers added mandatory address confirmation screens. Now, before you pay, you must press "Confirm" on the machine’s screen to verify the wallet address. If the ATM doesn’t show this step? Don’t use it.

Starting January 1, 2026, all crypto ATMs in the EU must do this. The U.S. is catching up. But until then? You’re the last line of defense.

Can You Get Your Money Back?

Almost never.

Blockchain transactions are irreversible. Once it’s sent, it’s gone. There’s no "undo" button. No chargeback. No customer service rep who can reverse it.

Some people have recovered funds by working with blockchain investigators. Reddit user u/BlockchainSherlock traced a stolen 0.25 BTC and got it back-but only because the scammer reused the same wallet across multiple attacks, and investigators linked it to known criminal activity.

That’s the exception. Not the rule.

Coinbase says it resolves 92% of QR scam reports within 24 hours. But that doesn’t mean they return your money. It means they lock the scammer’s account and help law enforcement. Your crypto? Still gone.

The Bigger Picture

QR code scams are just one piece of a $4.3 billion crypto fraud industry in 2025. But they’re growing fast. In H1 2025, they made up 19.7% of all crypto fraud-up from just 5.3% in H1 2024.

Experts like Harry Denley from Bitdefender say the real problem isn’t the tech. It’s the trust. "Users can generate their own QR codes through their wallet," he says. "But they choose to trust random websites instead."

That’s the flaw. Not the code. Not the machine. You.

But here’s the good news: You can fix it.

Next time you’re about to scan a QR code for crypto-pause. Ask yourself: "Did I generate this? Or did someone else give it to me?" If the answer isn’t "I did," then don’t scan. Type it. Verify it. Then send.

That one extra step? It’s the difference between losing $5,000 and keeping it.

Bagus Budi Santoso

scan qr code langsung kirim duit tanpa cek alamat? wow banget nih orang indonesia masih aja gampang percaya

Dimas Fn

gue pernah kena juga, cuma 0.02 btc sih, tapi pelajaran berharga banget. sekarang gue selalu ketik manual, walaupun ribet. lebih baik lama tapi aman daripada cepat tapi kosong dompetnya

Handoko Ahmad

eh tapi kalo QR code dari temen sendiri juga bisa jebakan lho, jangan lupa cek alamatnya! 😏

Asril Amirullah

ini bukan soal teknologi, ini soal kesadaran. setiap kali kamu mau scan QR, ingat: kamu bukan korban, kamu punya kuasa untuk berhenti. tarik napas, cek alamat, baru kirim. kamu bisa lebih bijak dari scammer itu. semangat, teman-teman!

Isaac Suydam

semua orang bodoh kalo percaya QR code. gue aja nggak percaya kalo ada yang kasih QR di ATM, apalagi di FB. kalo kamu kena, ya memang pantas kena. jangan nangis

Alifvia zahwa Widyasari

Anda tidak memahami esensi keamanan digital. QR code bukan masalah teknis, tapi masalah literasi. Anda harus mengerti bahwa blockchain tidak bisa di-reverse, dan kepercayaan tanpa verifikasi adalah bentuk kebodohan yang terstruktur. Silakan baca ulang bagian 'How to Protect Yourself' sebelum Anda membagikan lagi informasi ini.

Riyan Ferdiyanto

udah lama gue nggak percaya QR code dari orang asing, apalagi di atm. gue pake hardware wallet, setiap transaksi gue cek di layar fisiknya dulu. kalo nggak match, gue cancel. simpel banget sih, tapi banyak yang lupa

Dicky Agustiady

menarik banget nih. gue baru sadar kalo kita lebih percaya kecepatan daripada keamanan. padahal kalo dipikir, scan itu emang cepat, tapi kalo salah, ruginya gede banget. mungkin kita perlu lebih banyak edukasi yang santai, bukan cuma ngejelasin teknisnya

Hari Yustiawan

ini bukan cuma soal QR code, ini soal desain kepercayaan. Scammer itu bukan hacker jenius, mereka adalah psikolog ulung yang tahu kapan kita lelah, kapan kita buru-buru, kapan kita mau cepat kaya. Mereka nggak butuh kode canggih, mereka butuh kita untuk berhenti berpikir. Jadi, setiap kali kamu lihat QR code yang terlalu ‘mudah’, itu tanda bahaya. Jangan biarkan emosi menggantikan logika. Verifikasi. Selalu. Dengan tanganmu sendiri. Bahkan kalau kamu udah punya hardware wallet, tetap cek di layar. Karena yang namanya manusia, bisa lalai. Tapi kita bisa belajar. Dan belajar itu nggak usah malu. Gue dulu kena juga, 0.05 BTC. Sekarang, gue ngajarin semua temen gue: ‘Kalo kamu gak yakin, jangan scan. Ketik. Tanya. Tunggu. Ulangi.’ Itu bukan kelemahan. Itu kekuatan.

maulana kalkud

bro, gue baru aja baca ini, trus gue inget pas gue scan qr di atm bulan lalu, ternyata gue gak cek alamatnya, untung aja gue cuma beli 50rb, tapi kalo gue gak sadar, bisa jadi kaya orang2 di post ini. makasih ya, ini beneran ngebuka mata

nasrul .

semua orang bilang jangan scan qr code, tapi siapa yang ngajarin cara ngecek alamat wallet? kalo nggak ada panduan visual, gimana orang awam bisa ngerti?

NANDA SILVIANA AZHAR

terima kasih atas postingan ini 🙏 kalo aku kena scam, aku pasti bakal nangis dan nyalahin diri sendiri... tapi sekarang aku belajar, dan aku akan bagikan ke ibuku yang baru mulai pakai crypto. semoga kita semua bisa lebih aman 💙

Suilein Mock

Sejatinya, kegagalan sistem keamanan digital bukan terletak pada teknologi, melainkan pada ketergantungan epistemologis manusia terhadap simbol-simbol visual yang dianggap netral. QR code, sebagai representasi semiotik dari transaksi, telah dikolonisasi oleh kapitalisme predatori yang memanfaatkan kognisi heuristik-yaitu, kecenderungan manusia untuk berasumsi bahwa sesuatu yang cepat dan mudah adalah aman. Dalam konteks ini, bukan pengguna yang salah; ia adalah korban dari struktur yang dirancang untuk memanfaatkan kelemahan kognitifnya. Oleh karena itu, solusi yang tepat bukanlah 'jangan scan', melainkan membangun ulang paradigma kepercayaan digital melalui pendidikan kritis, bukan sekadar daftar periksa teknis yang dangkal.

ika lestari

Terima kasih atas informasi yang sangat lengkap dan jelas. Saya baru saja mengajarkan ini kepada adik saya yang baru mulai berinvestasi di crypto. Semoga semakin banyak orang yang menyadari betapa pentingnya verifikasi manual. Keamanan itu bukan pilihan, tapi keharusan.

Tulis komentar